$1.9 Billion Ethereum Unstaking Wave: Profit-Taking or a New Beginning for the Ecosystem?

Every bull run has its share of FUD.

Today, one development has reignited concerns about the price of ETH:

Ethereum network validators are lining up to withdraw staked ETH.

As the leading protocol for the Proof-of-Stake (PoS) consensus mechanism, ETH staking plays a crucial role: it secures the Ethereum network and provides stakers with yield and locks ETH liquidity within staking pools.

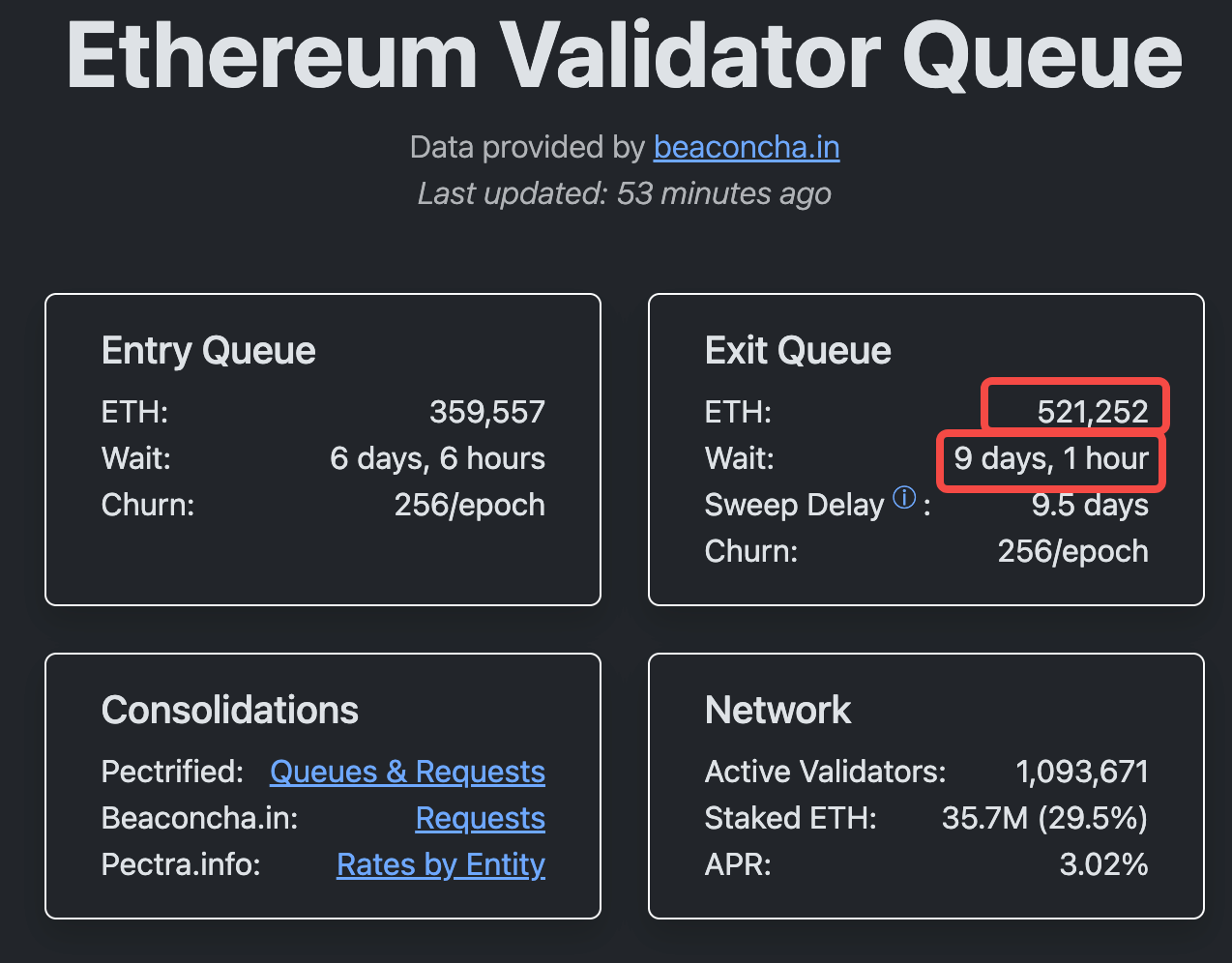

However, according to Validator Queue data, as of July 23, about 521,252 ETH were in the exit queue for unstaking—worth approximately $1.93 billion at current prices—with the withdrawal wait time exceeding nine days and one hour.

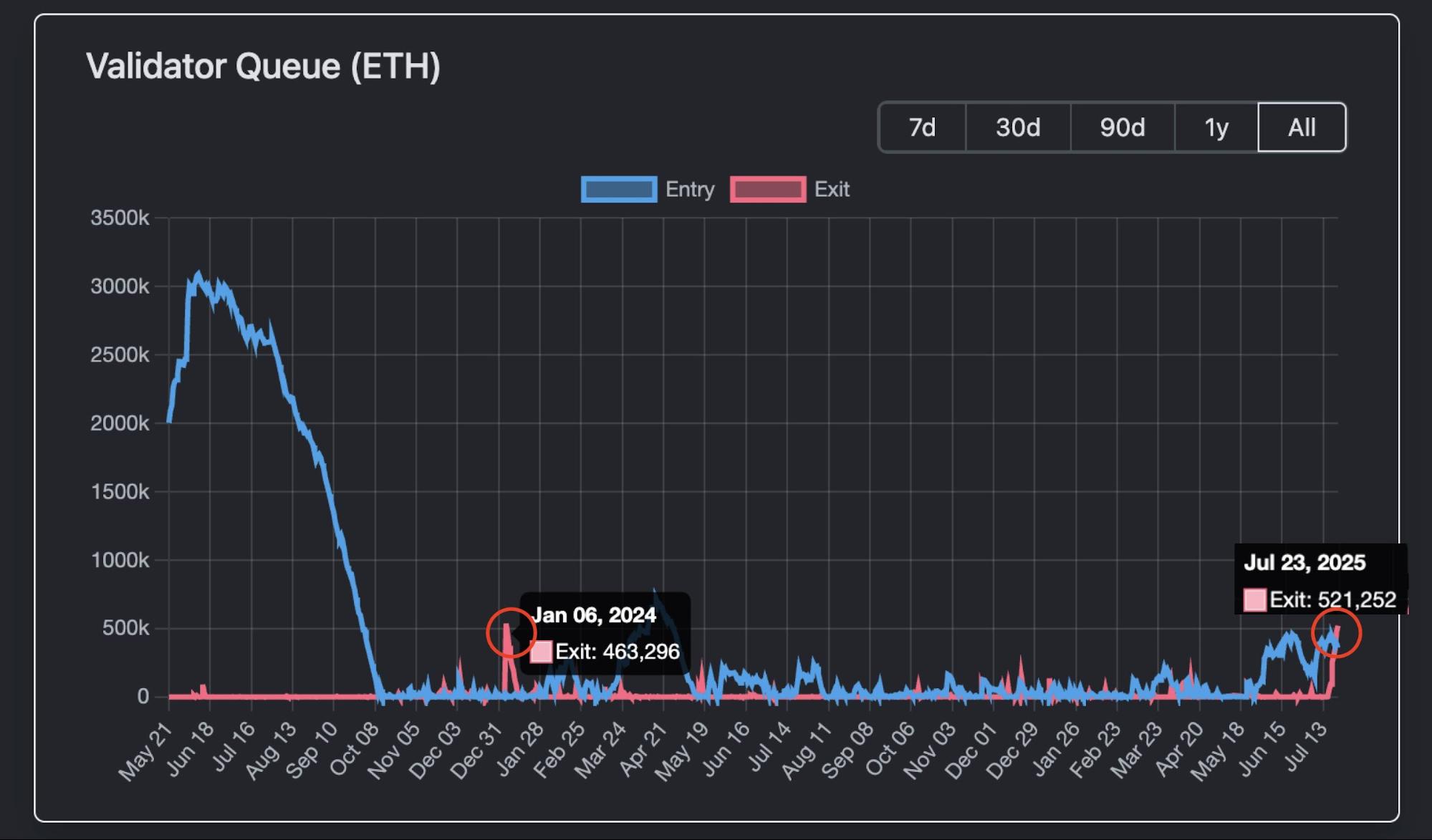

This is the longest validator exit queue seen over the past year.

Since each validator typically stakes 32 ETH, this means that in theory over 16,000 validators are seeking to exit. It is not surprising that such large-scale unstaking queues raise concerns.

Profit-Taking?

Are whales and institutions getting ready to sell ETH for profits?

The recent surge in ETH unstakes may be partly tied to the latest price rally.

ETH has staged a powerful rebound from its low in early April 2025 (around $1,500–$2,000). It has soared 160% to date. On July 21, ETH reached a seven-month high of $3,812.

Such rapid growth often prompts some investors to take profits—especially early stakers, who may choose to lock in gains rather than keep holding when returns look attractive.

This pattern isn’t new.

Between January and February 2024, the ETH/BTC price ratio jumped 25% in a week, triggering a similar wave of unstaking and a short-term ETH price drop of 10–15%. At the same time, the Celsius bankruptcy liquidation saw 460,000 ETH withdrawn in quick succession. This created about a week of exit queue congestion for Ethereum validators.

Not Direct Sell Pressure

This time, though, the lengthy ETH exit queue and large withdrawal amounts don’t necessarily spell direct sell pressure.

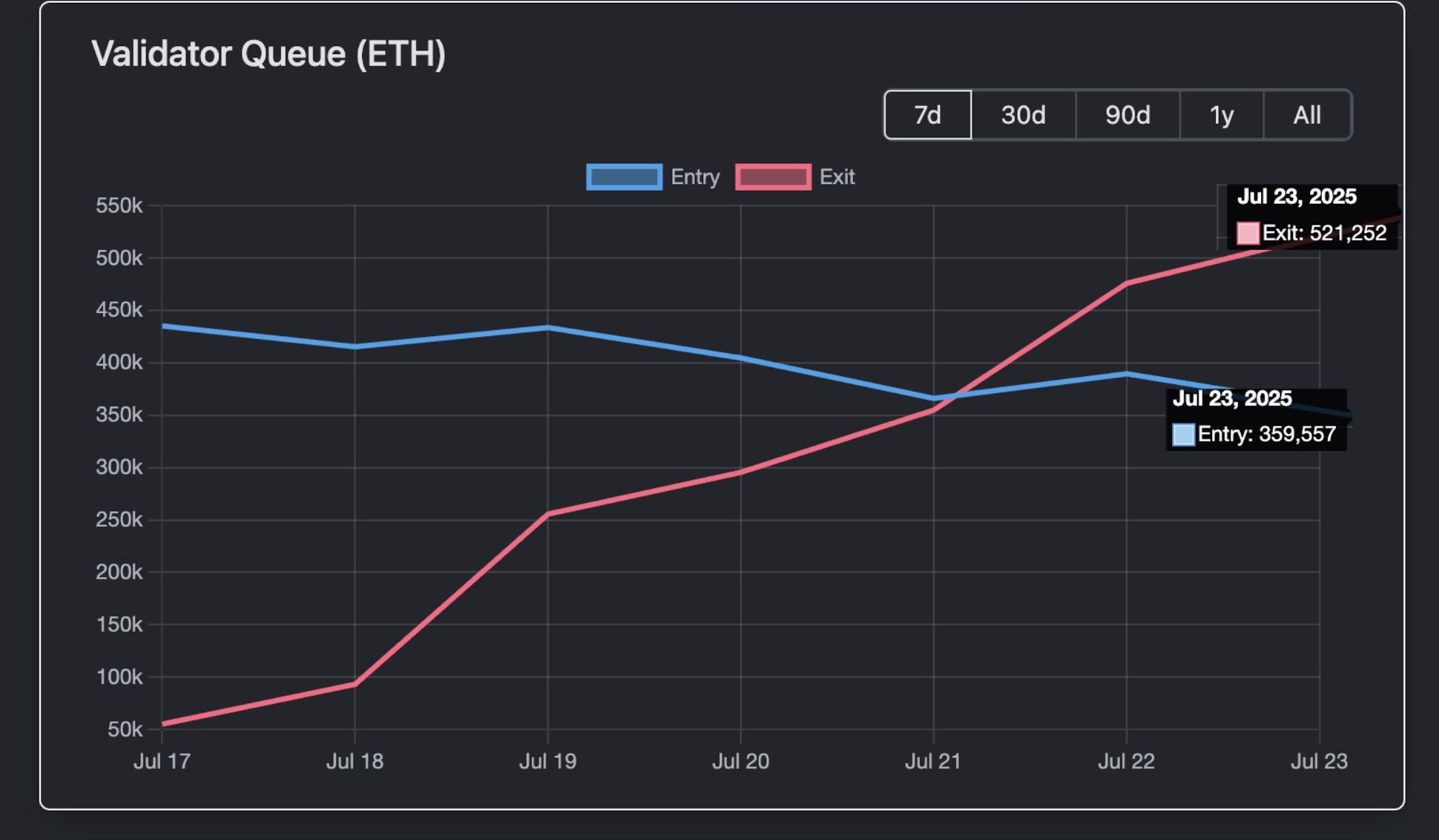

First, according to Validator Queue data, on July 23, while 520,000 ETH were queued for unstaking, 360,000 ETH entered staking during the same period.

These opposing flows mean that the net amount of ETH leaving the Ethereum network is much smaller.

Institutional inflows are also providing a cushion.

On July 22, total net inflows to spot ETH ETFs across institutions hit $3.1 billion on the open market. This is far greater in value than the 520,000 ETH ($1.9 billion) queued for unstaking that day.

That figure is just for a single day’s ETF inflow. It doesn’t account for the validator withdrawal queue’s nine-day delay.

Unstaking also doesn’t automatically mean selling.

In the current ETH bull market, large-scale unstaking may simply reflect institutions switching custodians or adjusting crypto treasury strategies—in short, moving ETH to new management for higher yield, not to sell off.

On-chain, much of the unstaked ETH is likely redirected into DeFi and NFT activities—whether as collateral or, for example, a whale recently sweeping the CryptoPunks floor.

Liquid staking tokens (LSTs) also frequently depeg, opening up arbitrage opportunities—recently, the stETH/ETH ratio slipped to 0.996 (a discount of about 0.04%), with similar moves in weETH. Arbitrageurs buy discounted LSTs and profit when parity returns, boosting ETH demand in the process.

Overall, most of this unstaking appears to be internal rebalancing within the Ethereum ecosystem, not a sign of a broad sell-off.

Rumors on social media abound. Even if mass unstaking doesn’t mean sell pressure, it does point to ownership change—what the industry calls a “passing of the baton.”

Some observers believe BlackRock, which is pushing crypto assets toward mainstream finance, has become ETH’s new institutional heavyweight. As of July, BlackRock reportedly held over 2 million ETH (worth roughly $6.9–8.9 billion), representing around 1.5–2% of total ETH supply (about 120 million ETH).

This is not a secret; it is public ETF asset management. It’s a sign of institutional “open leadership”—consolidating and growing positions via ETFs to drive institutional ETH adoption, not market manipulation.

The underlying logic is that as Ethereum shifts from a community-driven consensus to a widely accepted financial tool, Wall Street’s readiness to make major moves has become increasingly clear.

This reasoning is plausible: staking and unstaking might simply reflect a restructuring of ETH’s ownership base.

Ultimately, Ethereum’s growth will continue to support its leadership in the crypto industry. This wave of unstaking may mark the beginning of a new cycle.

Disclaimer:

- This article is republished from TechFlow, with copyright held by the original author TechFlow. For any concerns regarding this republication, please contact the Gate Learn team. We will address your request promptly according to our procedures.

- Disclaimer: The views and opinions expressed in this article are those of the author and do not constitute investment advice.

- Other language versions of this article have been translated by the Gate Learn team. Without explicit reference to Gate, it is prohibited to copy, distribute, or plagiarize the translated article.

Related Articles

What Is Ethereum 2.0? Understanding The Merge

Reflections on Ethereum Governance Following the 3074 Saga

An Introduction to ERC-20 Tokens

What is Neiro? All You Need to Know About NEIROETH in 2025

Our Across Thesis