Introducing RedStone Atom: A Lending Enhancement Engine Powered by Liquidation Intelligence

RedStone proudly unveils a major leap in oracle technology: RedStone Atom—the first-ever oracle with built-in liquidation intelligence.

Setting itself apart from legacy oracles, RedStone Atom is the first solution purpose-built to proactively enhance lending protocol performance. Its zero-latency updates empower protocols to liquidate positions faster, raise Loan-to-Value (LTV) thresholds, and deliver superior risk-adjusted returns compared to the competition.

Atom also automatically captures Oracle Extractable Value (OEV) as prices are posted to the blockchain, returning this captured value to protocols—enabling new revenue streams, higher yields for users, or reduced borrowing costs.

Powered by groundbreaking application-specific sequencing from FastLane Labs, Atom introduces no extra liquidation delays or added security assumptions.

RedStone Atom can be switched on for any RedStone data source on any blockchain—no code or engineering changes required.

Atom is currently live on Unichain, providing security for Compound Finance, Morpho, Venus Protocol, and Upshift. Integrations are available for BNB Chain, Base, Berachain—and coming soon to Ethereum, HyperEVM, Arbitrum, and more. To enable Atom on your preferred RedStone data source, contact the RedStone team.

Key takeaways:

- Enhanced lending performance: Atom transforms the oracle into a performance engine. Instant liquidations unlock higher LTVs and improved yields, creating measurable competitive advantages for protocols.

- Zero-latency liquidations: Atom instantly updates prices the moment liquidation is possible, unlocking stricter risk parameters and outpacing every competitor.

- Native OEV capture capability: Legacy oracles have leaked over $2 billion in OEV to MEV bots. Atom captures liquidation value via sealed auctions and returns it to the protocol.

- Atomic transactions: Price updates, liquidations, and OEV payouts are settled in a single transaction—about 300 milliseconds—on FastLane’s Atlas.

- Easy activation: Atom can go live immediately on any RedStone data source and chain, with no code or engineering changes necessary.

RedStone Atom: Redefining Lending Strength

“RedStone Atom is a fundamental revolution in the oracle sector—purpose-built for protocols, not simply bolted on. Atom delivers an unfair edge for lending protocols competing for the best yield, while solving DeFi’s multi-hundred-million-dollar OEV inefficiency. Simply put, Atom is the supercharged engine that DeFi lending has needed—engineered specifically for protocols.”

—Marcin Kazmierczak, Co-Founder, RedStone

Atom completely reinvents oracle technology and solves the most pressing problems of legacy oracles in DeFi.

Most lending protocols depend on so-called push-feed data sources, which only push price updates on-chain under predefined conditions—such as specific time intervals or price changes by a threshold percentage.

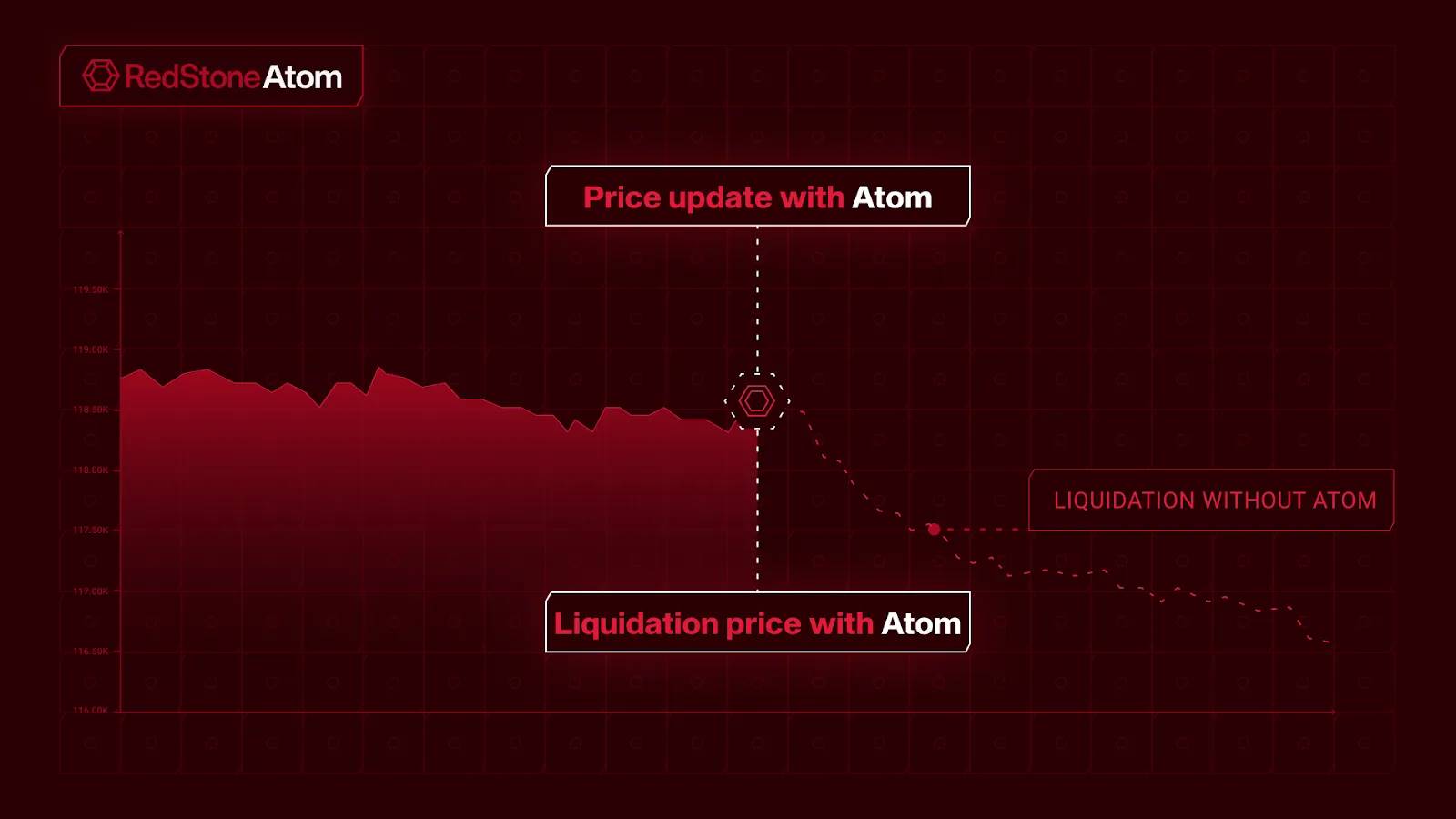

Once prices reach the blockchain, DeFi protocols use that data, often triggering liquidations. Faster oracle updates empower protocols to use more aggressive risk parameters, increasing borrowing power and enhancing attractiveness for DeFi users. Slow or delayed updates, on the other hand, force protocols to adopt cautious risk settings to prevent bad debt.

Each on-chain price update consumes gas, so traditional push-feed oracles usually update less frequently—trading off update granularity for sustainability. This throttles protocol performance: blockchain oracles update on their own schedule, not when the protocol needs it most.

RedStone Atom changes the game by enabling the first push-feed data source capable of instant, on-demand updates aligned with protocol needs.

Leveraging innovative application-specific sequencing, RedStone Atom upgrades RedStone data sources: whenever a new price can trigger a liquidation, anyone can call the update, enabling zero-latency price changes.

In lending, speed wins. With RedStone Atom, DeFi protocols execute liquidations faster and more efficiently than any rival—unlocking higher LTVs, better yields, and greater value for users. Protocols adopting Atom will outperform those reliant on legacy push-feed oracles.

$500 Million Problem: OEV and Limitations of Legacy Oracles

Since the first push-feed oracles hit Ethereum mainnet, Oracle Extractable Value (OEV) has represented a critical vulnerability. OEV is difficult to quantify, but even conservative estimates put cumulative losses at over $500 million. For Ethereum’s AAVE v2 and v3 alone, OEV losses may surpass $300 million.

Whenever a blockchain oracle posts a price that enables a protocol liquidation, OEV arises. To promote protocol security and ensure positions are liquidated before becoming bad debt, lending protocols offer “liquidation bonuses,” sometimes over 10% of the liquidation value. Because these liquidations present liquidators with virtually risk-free profits, competition is fierce and most of the bonus is spent as a priority fee—meaning protocols must pay dearly to protect themselves.

2024 saw the birth of the first OEV capture products. However, none have achieved mass adoption or captured significant OEV. Most current OEV solutions simply capture OEV without strengthening the underlying oracle foundation—and in many cases worsen the situation by adding liquidation latency or relying on off-chain infrastructure that’s hard to scale. Many approaches demand risky, time-consuming protocol upgrades, making them impractical for major markets.

RedStone defined four essential standards for its OEV solution:

- No liquidation delays—if anything, faster liquidations (which Atom achieves).

- No additional security risks or reliance on trust assumptions.

- Seamless scalability across any EVM-compatible chain.

- High OEV capture rates, targeting 90%+ of liquidations for integrated markets.

Atom OEV Auctions, Powered by FastLane

RedStone Atom meets these stringent criteria, taking OEV capture further with innovative application-specific sequencing technology.

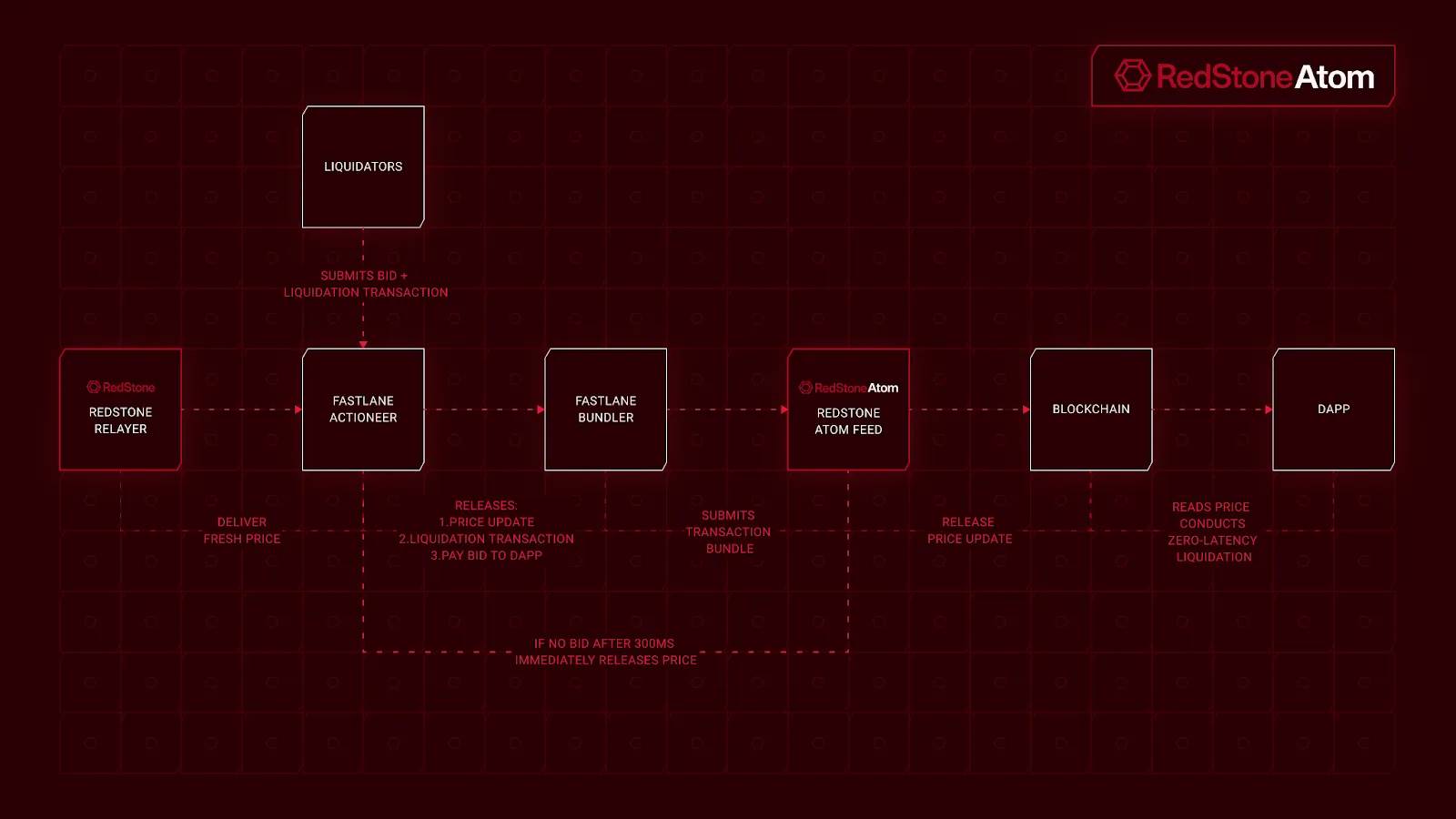

Inside Atom, RedStone data sources utilize FastLane’s Atlas to run Atom OEV auctions.

FastLane streams the latest RedStone price to off-chain auctions, each lasting less than 300 milliseconds. During this window, liquidators bid for the liquidation bonus.

When each auction concludes, FastLane submits bids to the Atlas smart contract in bid order. Atlas then atomically updates the data source and settles the auction to determine the winner on-chain. If a liquidator bid is present, Atlas atomically executes these three actions in a single transaction:

- Push the new signed oracle price

- Execute the liquidation

- Transfer the winning bid to the specified recipient

Because all three actions are atomically settled in the same block, the oracle update and liquidation are inseparable. There’s no room for front-running or missed liquidations due to protocol delays.

Whenever an off-chain price renders a position eligible for liquidation, Atlas launches a sealed-bid auction—lasting mere milliseconds—where liquidators (or any solver) compete for exclusive liquidation rights. If the winning bid fails, Atlas’s built-in try/catch instantly pivots to the next solver.

The protocol receives most of the liquidation bonus as income, with the winning auction participant keeping the rest. If no valid bid is made, RedStone relayers submit prices as usual, and the protocol continues its standard operations. If Atlas’s on-chain liquidation fails, the price update becomes open to everyone for standard liquidation.

In edge cases, the system falls back to the trusted default process; in the optimal state, liquidations are instant and the protocol captures the OEV.

“FastLane is building the real-time leveraged mint for DeFi: an optimized engine for liquidation risk. RedStone Atom delivers better results for protocols and their users, and helps restore permissionless innovation to on-chain DeFi.”

—Alex Watts, Founder, FastLane

Integrating RedStone Atom

No technical integration is needed to activate Atom. It’s an upgrade that can be natively enabled on any RedStone price feed and any chain. Once active, Atom enables zero-latency liquidations and native OEV capture for every protocol using that price feed—even with no change to the data source contract address.

To enable Atom, simply:

- Request Atom activation from RedStone for your relevant data source

- Provide an address to receive OEV

RedStone will deploy the Atlas contract on the specified blockchain and notify your team once Atom is live.

A New Era for Blockchain Oracle Technology

Atom launched first on Unichain, marking a significant advance in oracle innovation. Today, most blockchain oracles are largely indistinguishable (besides security records)—ETH/USD price feeds on the same chain are effectively identical. Atom is the disruptive differentiator.

Lending protocols that upgrade to Atom-powered feeds can use more aggressive risk parameters and outpace competitors, resulting in greater yields for users. This positions RedStone as the go-to data source for lending protocols.

No other blockchain oracle can truly match RedStone Atom. Competing architectures simply can’t achieve the same native integration as Atom can with RedStone’s modular approach.

RedStone and FastLane Labs will also retain a share of the OEV captured by Atom in a transparent, on-chain address dedicated to further protocol and ecosystem development.

For in-depth details on RedStone Atom, view our ETHcc 2025 presentations:

- RedStone Co-Founder Marcin Kazmierczak: https://www.youtube.com/watch?v=dQxkAPp3z9Y

- RedStone Atom Lead Mike Massari: https://youtu.be/M1YFKQZ55UM

About FastLane

FastLane brings deep MEV expertise, operating validator block auctions on Polygon PoS for years and currently covering about 75% of total staked assets. The latest partnership with RedStone focuses on building a permissionless execution layer for lending protocols, powering RedStone’s data infrastructure to expand safe leverage in DeFi.

About RedStone

RedStone is a modular blockchain oracle, tailor-made for DeFi and on-chain finance, with a focus on yield-generating assets such as value-accruing stablecoins, liquid staking tokens (LSTs), and restaking tokens (LRTs). RedStone delivers secure, robust, and customizable data feeds across more than 110 blockchains, earning the trust of over 170 clients, including Securitize, Ethena, Morpho, Drift, Compound, ether.fi, Lombard, and other leading DeFi protocols.

Disclaimer:

- This article is republished from [TechFlow] with copyright held by the original author [TechFlow]. If you have concerns about this republication, contact the Gate Learn Team, and we will address your request per established procedures.

- Disclaimer: The views and opinions expressed are solely those of the author and do not constitute investment advice.

- All translated versions are prepared by the Gate Learn Team and may not be copied, distributed, or plagiarized without explicit reference to Gate.com.

Related Articles

Solana Need L2s And Appchains?

The Future of Cross-Chain Bridges: Full-Chain Interoperability Becomes Inevitable, Liquidity Bridges Will Decline

Sui: How are users leveraging its speed, security, & scalability?

Navigating the Zero Knowledge Landscape

What Is Ethereum 2.0? Understanding The Merge