PancakeSwap vs Uniswap: A Comprehensive Analysis of the 2025 DEX Battle

1. PancakeSwap vs Uniswap Project Background

The Origin and Development of PancakeSwap

PancakeSwap was launched on September 20, 2020, as a decentralized exchange based on the BNB Chain, initially positioned as a low-cost alternative to Uniswap. Its team was anonymously created, and it quickly rose to prominence leveraging the high throughput and low transaction fees of the BNB Chain. As of March 2025, PancakeSwap has evolved into a comprehensive DeFi platform, offering functions such as liquidity mining, NFT marketplace, and Meme token launchpad, with a total trading volume exceeding $500 billion.

Source:PancakeSwap official website

The Birth and Evolution of Uniswap

Uniswap was founded by Hayden Adams on November 2, 2018, on Ethereum, and is one of the first DEXs to implement the Automated Market Maker (AMM) model. In September 2020, Uniswap introduced the governance token UNI, consolidating its community-driven model. By 2025, Uniswap has upgraded to version 4 (V4), introducing innovative features such as concentrated liquidity, maintaining its dominant position in the Ethereum ecosystem.

Source:Uniswap official website

The core difference between PancakeSwap and Uniswap

The background differences between PancakeSwap and Uniswap mainly lie in the choice of public chain and target users. PancakeSwap targets low-cost traders, while Uniswap serves a broader Ethereum user base.

2. PancakeSwap vs Uniswap Technical Principles

PancakeSwap’s technical architecture

PancakeSwap is based on BNB Chain, utilizing its processing power of 150-200 transactions per second and Gas fees as low as $0.01-$0.05. Its core is the AMM model, where users earn CAKE rewards by providing liquidity. In March 2025, PancakeSwap V3 optimized fee structure and supported multi-chain expansion.

Uniswap’s technological innovation

Uniswap runs on Ethereum, with mainnet TPS around 15-20, but can reach 1000+ on L2. The V4 version introduces ‘Hooks’ feature, allowing developers to customize trading logic, significantly improving capital efficiency in the concentrated liquidity model.

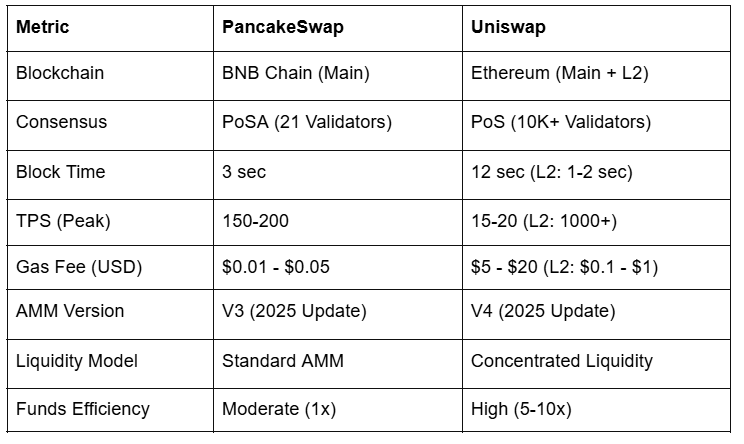

PancakeSwap vs Uniswap Technology Comparison

The technical differences between PancakeSwap and Uniswap are reflected in on-chain performance and depth of innovation. The table below provides a detailed comparison of the technical features of the two.

3. PancakeSwap vs Uniswap Economic Model

PancakeSwap’s CAKE economic design

CAKE is the governance and reward token of PancakeSwap. According to the latest data from Dune Analytics (as of March 26, 2025), the total supply of CAKE is 372,497,738 tokens, with a locked amount (veCAKE) of 66,856,506 tokens, accounting for approximately 18% of the total supply. PancakeSwap controls inflation through a burning mechanism, with a net burn of 3,458 tokens in the last week of March 2025, a total burn of 9,231,402 tokens, and a total mint of 9,227,944 tokens. On 3/26, the price of CAKE ranged from $2.48 (lowest) to $2.67 (highest), with a market cap of approximately $700 million.

Source:PancakeSwap CAKE Tokenomics

Uniswap’s UNI economic model

UNI is the governance token of Uniswap, with a total supply fixed at 1 billion. The 0.3% transaction fee is fully allocated to liquidity providers, with no burning mechanism. In March 2025, the price of UNI ranged from $5.99 (lowest) to $6.77 (highest), with a market cap of about $4 billion.

According to Dune Analytics data (as of March 26, 2025), the total trading volume of Uniswap V3 in the past 7 days was $397 million, and the total liquidity provider (LP) fees were $3.99 thousand. Among them, the top 15 trading pairs contributed $326 million in trading volume and $2.29 thousand in LP fees. The WETH/USDC trading pair had the highest trading volume, reaching $8.0511 million, with LP fees of $9.7561 million.

Source:Uniswap v3 Volume and Fees Collected

PancakeSwap vs Uniswap Economic Comparison

The difference between PancakeSwap and Uniswap’s economic models lies in token supply and incentive mechanisms. PancakeSwap controls inflation through destruction, continuously reducing the net supply of CAKE, while Uniswap relies on a fixed total supply to attract long-term holders. Uniswap’s LP fee distribution mechanism makes it more suitable for liquidity providers, but the lack of token burning may limit the long-term value growth of UNI.

4. PancakeSwap vs Uniswap Market Performance and Data Analysis

Trading volume and fee data

As of March 26, 2025, PancakeSwap’s 24-hour trading volume is $254 million, surpassing Uniswap’s $132 million. PancakeSwap’s weekly trading volume increased by 60.72%, while Uniswap decreased by 43.93%. In terms of daily fees, PancakeSwap is $61,700, and Uniswap is $13,200. According to Dune Analytics data, Uniswap V3’s total trading volume in the past 7 days is $397 million, with a total LP fee of $39,900, demonstrating its continued activity in the Ethereum ecosystem.

Market trend analysis

The rise of PancakeSwap is due to the meme token craze and cost advantage of BNB Chain. Uniswap’s TVL is $39.3 billion, higher than PancakeSwap’s $24 billion. The trading pair data of Uniswap V3 shows that mainstream pairs like WETH/USDC and WETH/USDT dominate, demonstrating its advantage in stablecoin trading.

PancakeSwap vs Uniswap Data Comparison

The table below shows the core market data for both on March 26, 2025:

5. Recent News and Development Trends

Latest news from PancakeSwap

- March 23, 2025: PancakeSwap Official X announced that its weekly trading volume reached $14.89 billion, surpassing Uniswap’s $8.29 billion, becoming the champion of DEX trading volume, with a growth rate of 60.72%, mainly driven by the Meme token craze).

- March 24, 2025: PancakeSwap launches perpetual contract trading for MUBARAK and BANANAS31, supporting leverage of up to 25x, further attracting high-frequency traders.

- March 26, 2025: PancakeSwap announced the perpetual contract of $PARTI (Particle Network) is online, providing 25x leverage, demonstrating its continuous support for new projects.

- March 20, 2025: PancakeSwap completes system upgrade, introduces MEV Guard, supports more wallets (such as Binance Wallet, Trust Wallet), and provides free protection for users against MEV attacks.

Latest developments of Uniswap

- March 20, 2025: Uniswap DAO has approved a $165 million funding plan to launch the “Uniswap Unleashed” program, including new grant initiatives and liquidity incentives, and plans to activate a “fee switch” to reward UNI holders.

- March 25, 2025: Uniswap’s official blog releases the V4 update log, optimizing Gas costs and expanding to more L2 networks (such as Arbitrum, Optimism), aiming to enhance competitiveness.

- February 26, 2025: Uniswap Labs announced that the U.S. SEC has ended its investigation without enforcement action, enhancing market confidence in its compliance.

Future Outlook of PancakeSwap vs Uniswap

The future competition between PancakeSwap and Uniswap will focus on multi-chain expansion and user experience. PancakeSwap maintains its trading volume advantage with low costs and the meme token craze, while Uniswap consolidates its ecosystem position through technological innovation and L2 integration.

6. Summary

The competition between PancakeSwap and Uniswap is a fascinating game in the DeFi field. With the low cost and high efficiency of BNB Chain, PancakeSwap surpassed Uniswap in March 2025 with a trading volume of $254 million, compared to Uniswap’s $132 million, becoming the leader of DEX. Its daily fee income of $61,700 far exceeds Uniswap’s $13,200, demonstrating strong user attraction. However, Uniswap, with a TVL of $39.3 billion and technological innovation, remains the cornerstone of the Ethereum ecosystem.

Each has its own merits in terms of economic models: CAKE maintains vitality through a burning mechanism, while UNI attracts long-term investors with a fixed supply. In the future, the outcome of PancakeSwap vs Uniswap will depend on the balance of cost, technology, and ecosystem expansion. On the Gate platform, the performance of these two projects is worth continuous attention.

Related Articles

Pi Coin Transaction Guide: How to Transfer to Gate.io

What is N2: An AI-Driven Layer 2 Solution

Grok AI, GrokCoin & Grok: the Hype and Reality

How to Sell Pi Coin: A Beginner's Guide

Crypto Trends in 2025